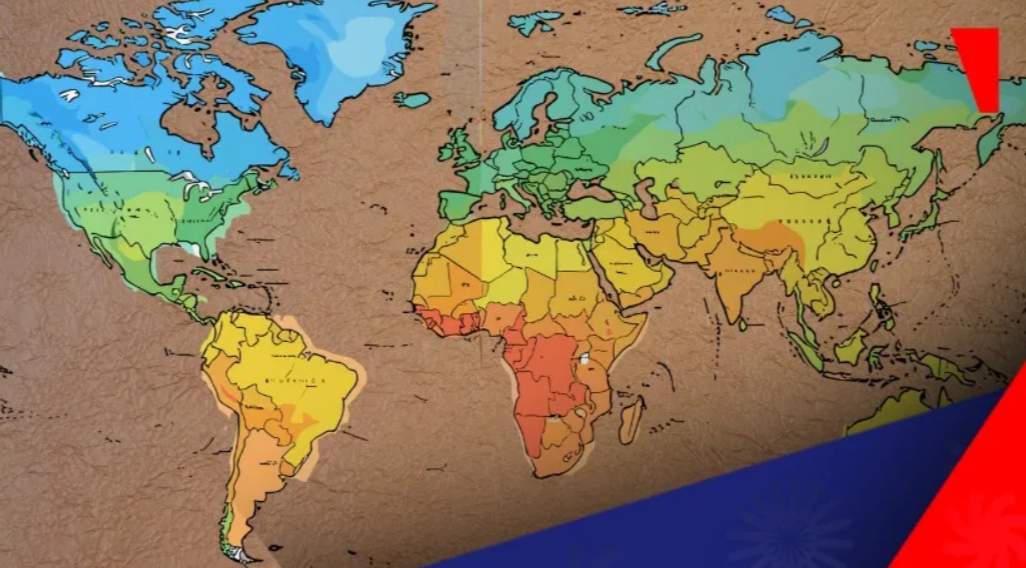

The online gambling industry in Africa is growing rapidly in different jurisdictions. With an increasing number of smartphone users, the accessibility of online gambling sites is changing in real time. The young and tech-savvy population in these countries is contributing to a quicker uptake in these major markets. The regulatory environment is changing, albeit at different rates, in these countries.

Countries including Nigeria, Kenya, and South Africa have become focal points for international operators. However, growth has exposed significant gaps in market understanding.

Reliable, localised information remains difficult for players to access. This challenge has pushed some analysts to rethink comparison models entirely. One such figure is Maxime Lebail, Brand Manager at ChampsBase.com. Lebail has spent over a decade analysing European gambling markets. His recent focus has shifted decisively toward Africa’s emerging ecosystems.

Frustration sparked the expansion

ChampsBase’s move into Africa did not follow a conventional expansion playbook. Instead, it emerged from dissatisfaction with existing comparison platforms. “Honestly, it started with frustration,” Lebail shared with Business Post. “When we looked at the gambling comparison space in markets like Nigeria, we found two extremes — either global platforms that barely acknowledged local realities, or local sites with questionable editorial standards.”

He identified a missing middle ground. “There was a gap for something in between: rigorous, research-driven content that actually speaks to Nigerian players specifically,” Lebail emphasised Africa’s diversity from the outset. “The African market isn’t a monolith.” “A player in Lagos has different needs, different payment habits, different concerns than someone in Nairobi or Johannesburg.” That complexity shaped ChampsBase’s strategy from inception. “We wanted to build something that reflected that.”

Localisation goes far beyond language

Localisation is often misunderstood as simple translation. Lebail strongly rejects that interpretation. “Translation is maybe five percent of the work,” he explained. “Real localisation means understanding what builds trust in a specific market.”

Nigeria provides a clear example. “Take Nigeria as an example.” “Bank transfers and USSD payments matter far more than credit cards.”

Trust indicators differ sharply from European expectations. “Players want to know if an operator has a local presence, if withdrawals actually work, if customer support understands their issues.” “These aren’t things you can fake or copy from a European template.”

ChampsBase prioritises operational performance over promotional appeal. “Operational performance is more important to us than marketing appeal. We’ve spent a lot of time researching which operators really serve Nigerian players well, not just those with the most attractive bonus offers. Our research is directly applicable to our consumer-focused content, such as our page on the best betting sites in Nigeria, which is updated regularly based on consumer feedback and our own experience.”

Navigating Africa’s fragmented regulation

Regulatory inconsistency remains one of Africa’s limiting challenges. Lebail describes the landscape as deeply uneven. “It’s complex, and I won’t pretend otherwise,” he said. “Nigeria has made significant progress with the National Lottery Regulatory Commission, but enforcement remains inconsistent across states.”

Other markets present even greater ambiguity. “Other markets are even more ambiguous.” ChampsBase adopts a cautious editorial policy. “Our approach is conservative.”

“We only feature operators that hold valid licences in the jurisdictions they operate in.” Uncertainty is addressed transparently. “If the regulatory status is unclear, we flag it explicitly.” “Players deserve to know the risks.”

Lebail believes short-term growth often undermines industry credibility. “I think there’s a tendency in this industry to chase growth at any cost, but that creates long-term problems — for players and for the industry’s reputation.” “We’d rather build slowly and maintain credibility.”

Rebuilding trust in comparison platforms

Comparison sites often face scepticism from players. Lebail acknowledges the reputation problem openly. “By being transparent about how we operate,” he explained.

“Yes, we earn commissions when players sign up through our links — that’s the affiliate model, and we don’t hide it.” “But editorial independence is non-negotiable.” Consistency underpins ChampsBase’s review process. “Every review follows the same methodology.”

The evaluation criteria focus on operational realities. “We test registration processes, deposit and withdrawal speeds, customer support responsiveness, bonus terms — the boring stuff that actually matters.”

Commercial relationships do not guarantee favourable coverage. “If an operator performs poorly, we say so, even if they’re a commercial partner.” Lebail draws lessons from his European experience. “I’ve been in this industry for over a decade, mostly focused on European markets like Portugal.” “The operators who succeed long-term are those who treat players fairly.” “The same principle applies to comparison platforms.”

Mobile-first realities reshape Africa’s content

User behaviour differs sharply between continents. For example, mobile usage dominates African markets. “Mobile is everything here,” Lebail said. “In Portugal or France, desktops still have a significant share.” “In Nigeria, we’re talking about ninety percent mobile traffic, often on lower-bandwidth connections.”

That reality influences design decisions. “That changes how we structure content — shorter paragraphs, faster-loading pages, information hierarchy optimised for small screens.”

Sports engagement also differs in intensity. “There’s also a different relationship with sports.” Football’s cultural role remains central. “Football is universal, but the depth of engagement with local leagues, with the Premier League, with betting as a social activity — it’s intense in ways that European markets have somewhat lost.”

Lebail views this intensity as both opportunity and responsibility. “That passion is exciting, but it also means we have a responsibility to promote responsible gambling practices clearly.”

Responsible gambling as a core principle

While responsible gambling is often on the fringes in emerging markets, ChampsBase puts it front and centre. “It can’t be an afterthought,” Lebail says. “We include responsible gambling information into every guide and every review.”

Educational clarity remains a priority for them. “We explain how self-exclusion works, how to set deposit limits, where to find help if gambling stops being fun.”

Lebail acknowledges the cost of commercial trade-offs. “Is it glamorous content? No.” “Does it generate clicks? Not really.” This emphasis is on the long-term effect, not short-term numbers. “But it’s the right thing to do, and regulators across Africa are increasingly paying attention to this.” “Operators and affiliates who ignore responsible gambling now will face problems later.”

Building for Africa’s next phase

ChampsBase’s African strategy continues to expand. “Deeper coverage of more markets — Kenya and South Africa are priorities for this year,” Lebail said. Lebail says that education remains a central focus.“We’re also investing in more educational content.”

Many users are new to betting ecosystems. “Not everyone who visits a comparison site is an experienced player.” “Many are curious newcomers who need guidance on the basics.” That guidance covers foundational knowledge.

“How odds work, how to verify an operator’s licence, how to manage a betting budget.” Lebail sees success in measured outcomes. “If we can be the platform that helps someone make informed decisions rather than impulsive ones, we’ve done our job.”

#AfricanGaming #OnlineGambling #iGamingAfrica #ResponsibleGambling #MarketInsights #MobileFirst #PlayerProtection #iGamingNews #EmergingMarkets