Brazil’s online gambling sector has been rocked by bad news in recent weeks, particularly after the government enacted a provisional measure to increase the tax rate on GGR by 50%. Despite a successful market launch in January, the sector has faced staunch opposition from trade unions, political groups and even banks, and a gambling tax hike could severely stunt the flourishing sector.

And a mere six months into the nascent market’s existence it has become an easy target for plugging budgetary gaps, as President Lula insists sectors like gambling do not pay enough in state contributions.

At the time of the announcement, on 3 June, Brazil’s gambling trade bodies had denounced the proposed policy, warning it could spur black market growth.

The policy change seems straightforward in that the gambling tax rate will increase from 12% to 18% of GGR for all operators, but the reasoning behind the change is complex and the process for the policy to be enacted is shrouded in even more uncertainty

João Rafael Gandara, tax lawyer at Brazilian firm Pinheiro Neto Advogados, tells iGB the policy may not even pass, as it must be enacted within 60 days of the Senate issuing the bill. It can be extended by another 60 days, so 120 days in total.

He also believes the sector could leverage the Congress’ recent pushback against broad tax hikes in the country.

The government hinted at changes in the country’s taxation system in late May, when it announced controversial plans to raise the rate of financial transactions tax (IOF) from 0.38% to 3.5%.

The IOF was introduced in Brazil as a monetary policy by the government, to help control financial markets. IOF must be paid on foreign transactions such as loans, foreign exchange, insurance and investments. It is a significant contributor to the government’s tax revenue.

Almost immediately the move faced pressure from the Congress and the government quickly scrapped the decree to raise the IOF rate.

But the current government, led by President Lula, has plans to decrease Brazil’s deficit significantly by the end of 2025, ahead of an election next year. So instead of increasing the IOF, it has turned to the betting sector to help fill a BRL20 billion gap. Other sectors like agriculture are also facing tax hikes to help balance the budget.

Gandara believes the policy could end up being scrapped if the provisional measures are not approved by Congress within a 120-day window. However, despite it not having been formally voted on by Congress, the provisional measure took immediate legal effect in June. The increased tax rate will be implemented 90 days after the decree was published. This means if the measure isn’t made permanent after 120 days, any taxes taken from the 90-day mark onwards must be returned to operators.

Gandara cites recent examples of Congress swiftly rejecting provisional measures, which could provide some hope for the gambling sector after the hugely negative response to the tax increase and a generally negative perception of the government’s tax policies.

“We had a recent precedent within the last year where the president of the Congress immediately returned [a policy], saying ‘this has no chance of going [through] and I won’t even start the legal proceedings, so we will immediately reject [this provisional measure].’

“And you normally have that when he has the majority of Congress backing him. That was the [outcome] the last time we had this type of problem.”

The policy in question was a provisional measure that limited companies’ ability to use tax credits and extinguished cash reimbursements of presumed credits.

Last week, the Chamber of Deputies gave urgent status to a bill that would overturn the effects of the government’s IOF decree. This means it won’t go through any parliamentary committees before being voted upon.

This is a fresh indicator the Congress does not support the government’s tax increase efforts to try and reduce its deficit.

Gandara agrees the government is going the wrong way about eliminating the deficit, by targeting a “clearly overtaxed” gambling sector, which he believes is an “easy target” due to its current negative reputation.

“I think across the whole world, like in the US and Europe, governments are cutting expenses,” Gandara explains. “The other [option] is to raise taxes.

“The government needs to cut from expenses and they know it’s a hard discussion [to have], so they avoid it and they are really targeting whomever they can. [Gambling is a] new industry and they’re getting a regular income, they’re not the villains of the story.”

Gandara says taxation is a particularly contested topic in Brazil, which continues to dominate national headlines while elsewhere, US President Trump and conflicts in the Middle East are making up the headlines.

As the government’s tax raising policy is so controversial, Gandara feels an effectively formulated response from the gambling sector could overthrow the provisional policy.

“[Taxes] are really a hot topic and I think the government will have a very hard time [convincing] the Congress,” he adds.

“So maybe if there is a really well organised strategy, explaining to the Congress that this type of taxation can really harm the [sector] and wider government strategy, maybe they can get the policy rejected.”

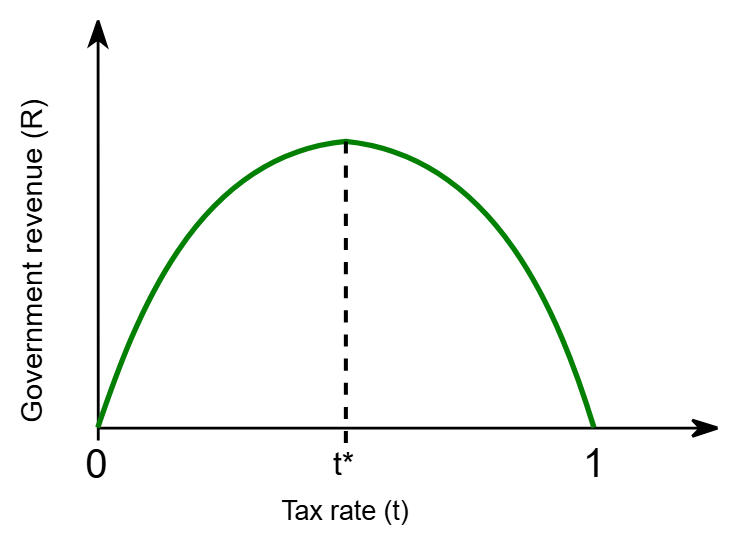

Gandara cites the Laffer Curve, a widely known graph that shows if a tax rate is raised too high, the funds collected start to drop off as companies either leave the country or consumers turn to illegitimate offerings to avoid paying more for a product or service.

“There’s an optimal point,” Gandara says. “If you push [beyond] that, you are no longer collecting taxes because either companies have left the country, or everyone is in the black market.”

“What the government should be doing is the opposite, presenting a reasonable tax so they have this optimal collection and you have other companies coming [into the market],” he concludes.